As earnings reports are rolling in, it may be a good time to take stock of the results companies are reporting and how these results compare against the past. Below is a summary table of the TCE/day for several owners who released their annual reports recently:

Looking at the product Tanker earnings, it is apparent that despite some volatility, the earnings have been substantially higher than the long-term average from before the Ukraine war – on average, the owners have been making twice as much money as compared to the period before 2022. The windfall profits have been put to good use by ordering new ships, retrofitting existing ones with cleaner and more efficient technologies, paying dividends to the shareholders and reducing debt. The result of this is that for many owners the breakeven point has fallen over the past 2-3 years with some reporting it to be below $15,000/day, therefore making them even more profitable. The sustained high earnings and profitability have kept the swing tonnage largely employed in the products market and away from the chemicals trade.

This has supported the Chemical Tankers market, where freight rates remain currently elevated and above historical long-term averages and owners reporting healthy earnings. But what goes up eventually must come down, so the question that many people may be asking themselves is “When can we finally expect reversal to more affordable freight rates and some sort of normalisation?”.

Enter the New Normal.

There are multiple indications that the freight rates from the good old days may be a thing of the past – at least in the short and medium term.

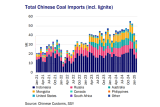

First, the sanctions against Russia and the resulting big change in trade flows, will likely remain for the foreseeable future. Europe will continue importing fuels from further afield, while Russian products will be exported to Asia, South America, Africa, Middle East, and Turkey. At the same time, Middle Eastern countries will take advantage whenever possible of the arbitrage by importing cheap Russian products and exporting their own. All this will provide support for the ton-miles demand for product ankers, keeping them busy.

Secondly, the widely anticipated changes in the global refinery landscape of closing older and less efficient capacity in Europe, Japan, North America, and Australia and adding new capacity in China, India, Middle East, and Africa, will have the effect of further supporting or boosting the ton-miles demand.

Thirdly, with long-term rainfall trends pointing down, some restrictions on Panama Canal transits seem likely to remain in place. The disruption will continue contributing to the strength of the Tanker market as many owners choose to avoid costly delays and route their vessels via the Cape of Good Hope instead.

Fourth, as long as Israel continues its offensive in Gaza, the Red Sea disruption will continue impacting the market, forcing ships to sail via the Cape of Good Hope, again boosting ton-mile demand and keeping the market tight. But if tensions between Israel, Iran and Hezbollah continue escalating, the disruption may expand to cover Indian Ocean and the Eastern Mediterranean, causing more vessel deviations.

Fifth, huge Chinese petrochemical overcapacity of about 100 million mt and slowdown in domestic demand means Chinese exports will continue especially to destinations with inefficient / insufficient own capacity, again providing support for ton-miles demand.

Sixth, if inflation worldwide continues falling and central banks start cutting interest rates, the economies will start growing faster which will stimulate consumption and by default – international trade.

And last but not least, on the supply side of the equation, the chemical fleet will see slow growth of just 1%/year through 2026, while the product tanker fleet is expected to grow by about 3%/year for the same period. Given all the factors contributing to higher ton-mile demand, it looks very likely that demand will continue outstripping supply. Some charterers are already waking up to this fact and have started accepting vessels above 30 years old, as long as they are well maintained. But the obvious conclusion is that, given the fundamentals, freight rates are likely to stay higher for longer.

By Plamen Aleksandrov, Market Researcher, Chemicals, SSY

Articles

You may also be

interested in

View allGet in touch

Contact us today to find out how our expert team can support your business